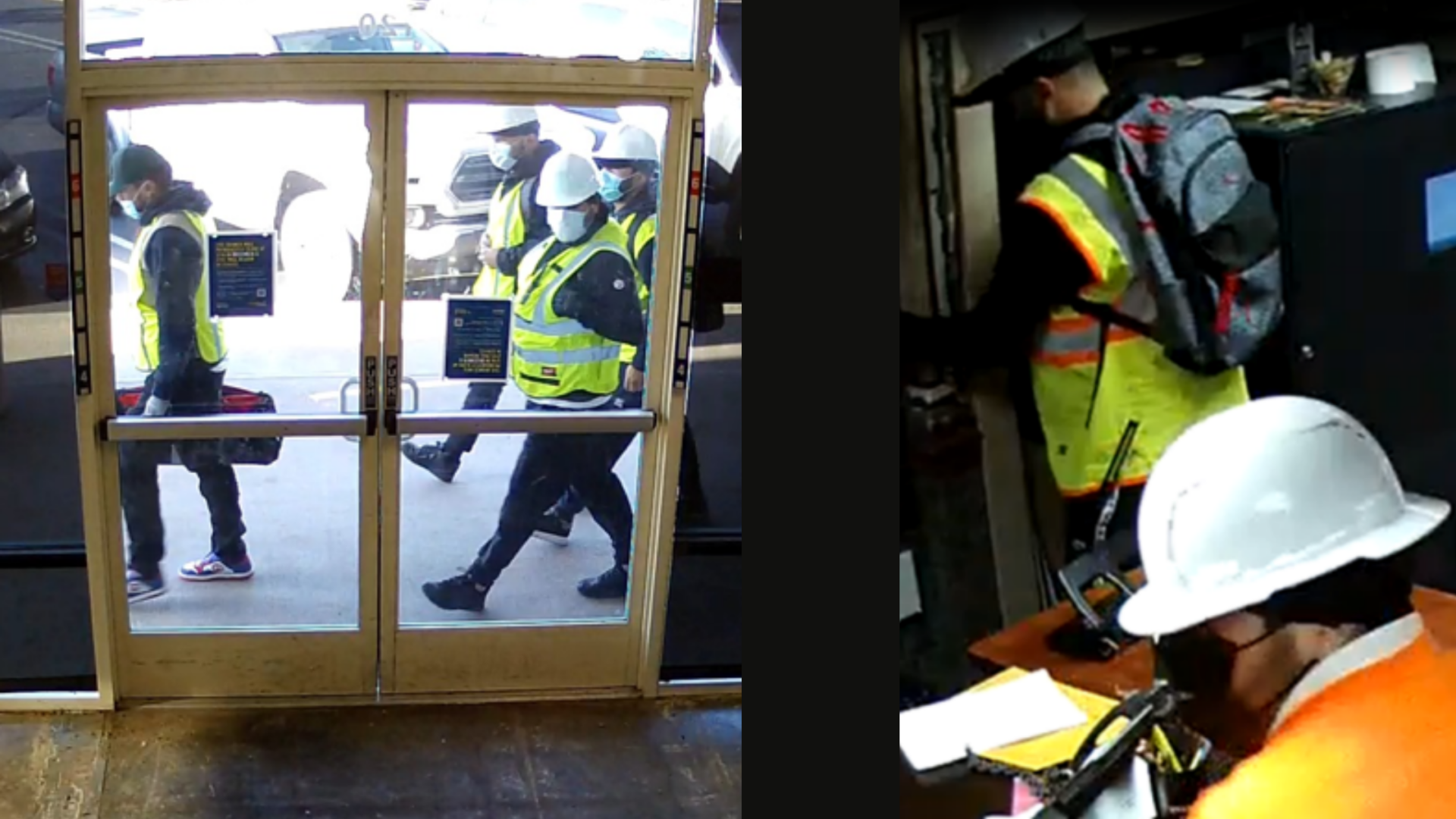

At the TD Bank annual general meeting, CEO Bharat Masrani addressed the bank’s pressing issue of an ongoing investigation by U.S. regulators concerning anti-money laundering (AML) practices. This probe has been ongoing for two years and has raised significant concerns about the bank’s compliance systems.

TD Bank CEO, Bharat Masrani, Speaks on AML Practices

In his remarks, Masrani admitted that TD Bank’s internal AML practices had not met regulatory standards. But he quickly acknowledged the steps TD is taking to enhance compliance. “We have onboarded globally recognized talent and leadership and invested in technology, process design, training, and other activities,” Masrani stated. He purposefully emphasized the bank’s commitment to resolving its compliance issues.

In-Depth Look at Anti-Money Laundering (AML)

AML laws are crucial for preventing the flow of illicit funds and maintaining the integrity of the global financial system.

The regulations associated with countering AML require financial institutions to:

- Monitor clients’ transactions continuously

- Report large cash transactions

- Maintain robust systems to flag suspicious activities

Effective AML programs are vital for deterring criminals from using banks to launder money, finance terrorism, or engage in other illegal activities. Many Bank’s efforts to bolster AML capabilities reflect their commitment to upholding these essential financial safeguards.

Uncertainty Surrounds TD Bank’s CEO Succession

With CEO Bharat Masrani approaching retirement, TD Bank also faces uncertainty around his replacement. Investors have expressed concern about the bank’s future leadership, especially following the departure of Michael Rhodes, a potential successor.

Masrani reassured stakeholders, stating, “A bank of our size, scale, and profile would have very robust succession plans — and we do.”

He promised a smooth transition that will continue TD’s legacy of consistent, strong leadership.

AML Probe & CEO Succession: Masrani Addresses Pressing Issues for TD Bank

In his remarks, Masrani projected confidence and dedication in the bank’s ability to navigate the current AML issues and oncoming opening at the top.

He reassured attendees: “I wake up every morning saying ‘How can we serve customers even better, create more value for our shareholders?’ I feel great.”

Full coverage of the TD Bank annual meeting is at Banking Dive.