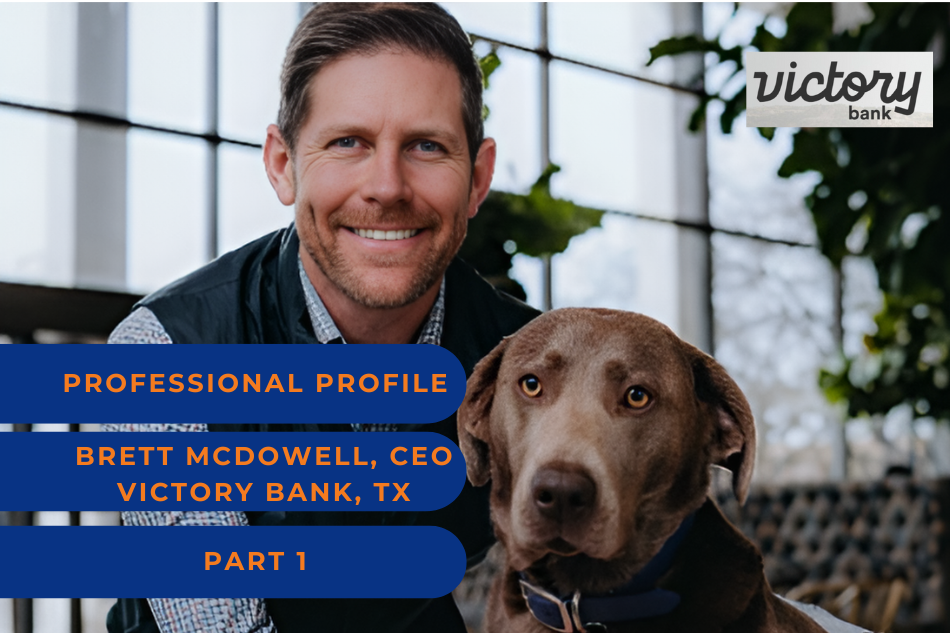

In part one of this two-part Banking+ interview, Brett McDowell, CEO and Co-Founder of Victory Bank in Lubbock, Texas, retraces his career path, citing a valuable mentor and the genesis of his financial institution.

McDowell’s Early Influences & Shaping a Path

McDowell is a fifth-generation rancher from Northeastern New Mexico, where Texas, Oklahoma, Kansas, Colorado, and New Mexico converge.

As a young adult, he initially considered careers in veterinary medicine and even briefly contemplated medical school. The weight of responsibility in those fields, however, didn’t quite align for him. “Dealing with different types of decisions—financial or legal, for example—seemed more up my alley,” McDowell reflected.

He pursued a path toward law school after completing his undergraduate studies, seeing it as a way to guide his business inclinations into a career.

The one thing that wasn’t quite in his vision at that time, however, was banking.

“Outside of knowing a good example of a community banker growing up, I didn’t really know much about it,” McDowell admitted.

The Mentor Who Sparked a Banking Passion

That game-changing community banker opened McDowell’s eyes to the impact a financial services professional can have on a community. The impression was significant enough to point his career interests to banking.

Among numerous upsides to a banking career, McDowell was impressed by how highly involved this individual was. He witnessed this person’s influence in affecting local lives, from awarding useful scholarships to something as simple as judging academic competitions.

McDowell came to deeply admire the career’s reliance on balancing numerous responsibilities and remaining actively engaged with the public.

Internalizing the examples McDowell saw of a wholly community-focused business approach has yielded several lasting impressions on him. He readily cites one: the importance of being hands-on and working alongside his team.

This early-career mentor was so influential, McDowell maintains the relationship, periodically turning to his champion for guidance and practical advice.

Victory Bank’s Growth & Community Focus

Victory Bank is headquartered in Lubbock, Tx. The city is home to 300,000 residents and Texas Tech University. The bedrock of its culinary scene is mouthwatering beef and brisket, sourced locally. The region also thrives on oil, gas, and cotton production, making it a significant service, industrial, and medical hub in West Texas.

Victory Bank was started with assets of about $70 million and has grown to $150 million. In agreeing to helm the institution, McDowell—with his background in a bank that grew from $275 million to $1 billion in assets—seized the opportunity to establish a tech-forward community bank.

Victory Bank has undergone significant changes, including a core conversion and acquiring a small, traditional family-owned bank in the Abilene area. The team has expanded from 15–16 employees to 29 or so, with a mix of new hires and existing staff in three locations.

McDowell explains that Victory Bank aims to blend traditional community banking values with a forward-looking approach, offering comprehensive services while maintaining close customer relationships. The bank focuses on integrating technology with personal service to create an exceptional customer experience, ensuring smooth operations and customer satisfaction.

The bank’s recruiting process focuses on finding individuals who are not only skilled but also innovative and adaptable. McDowell values traditional banking expertise but seeks employees excited about technology and continuous improvement. This blend, he says, ensures that the bank remains innovative while maintaining its strong community roots.

Balancing Tech & Relationships: A Recipe for Community Banking Success

McDowell emphasizes the importance of striking a balance between technology and personal service. He believes thriving community banks should seamlessly integrate innovative approaches with strong foundational practices. This philosophy guides Victory Bank’s growth strategy, prioritizing quality and strategic expansion to ensure the bank retains its culture and effectively serves the community.

Dive Deeper in Part 2: McDowell’s Banking Insights & Victory Bank’s Future

In the second part of this Banking+ Professional Profile series, we delve deeper into McDowell’s vision. Explore his approach to building a strong company culture, fostering core values, navigating technological advancements, and shaping the future of Victory Bank.

Continue reading Part 2 of this story, Building Victory Bank: The Future of Community Banking Tech & Relationships.

Please subscribe to stay up-to-date on the latest Banking+ News or watch Brett’s interview in its entirety below!