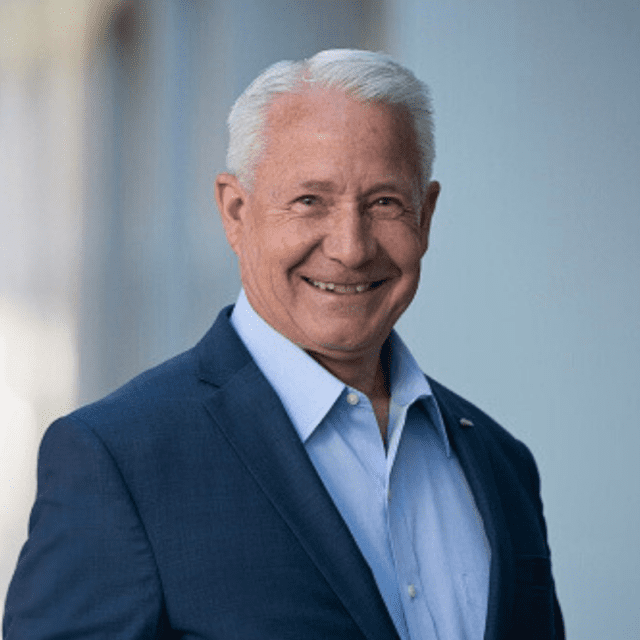

The banking journey of Tim Schneider—President and CEO of Bank Five Nine in Oconomowoc, Wisc.—began 37 years ago after he graduated from the University of Wisconsin, River Falls.

But before that, he grew up on a dairy farm.

That agrarian foundation opened his entry into the financial services industry, as an ag lender with the Farm Credit system in Fon du Lac, Wisc.

Schneider’s diverse career would continue to unfold, eventually encompassing commercial banking, mortgage banking, and personal banking, providing him with a well-rounded foundation for his eventual leadership position.

From Dairy Farm to Finance: Tim Schneider’s Early Career

Schneider’s extensive experience eventually led him to cofound a new bank with three colleagues he met at Firstar in Manitowoc, Wisc. The impetus for striking out on their own resulted from a sense of disappointment with Firstar’s seeming lack of commitment to the agricultural industry, particularly the dairy sector.

Their new financial institution, Investors Community Bank, initially focused on agricultural loans. But the principals soon diversified into commercial lending to ensure sustainable growth.

Over 22 years, they grew the bank to $1.5 billion in assets before selling it to Nicolet National Bank in December 2021. Schneider stayed on as SVP of Ag for 10 months to stabilize the group and integrate it into Nicolet’s culture.

Leading Bank Five Nine: A New Chapter

In October 2022, Schneider transitioned to Bank Five Nine. Intrigued by the bank’s size, geography, and culture, he accepted the CEO role.

Bank Five Nine, previously known as First Bank Financial Centre, rebranded to distinguish itself from other similarly named institutions. The rebranding highlighted the bank’s long history, being the second oldest in Wisconsin.

One significant change for Schneider was the shift away from agricultural lending. Instead, Bank Five Nine strategically focuses on less-risky, SBA-supported commercial lending. The bank is recognized as the top SBA 504 lender in the country.

Tim’s Treat and Building Community Initiatives

To engage younger customers, Bank Five Nine has implemented innovative initiatives that include a “mascot banking” program. The initiative allows students to open accounts and receive debit cards personalized with images of their high school mascots. The custom look fosters a sense of pride and loyalty, both within the school and at the bank.

In addition, Schneider has championed community involvement through initiatives like Tim’s Treat. He uses this outreach to visit local businesses, distribute gift cards, and promote random acts of kindness.

As noted on the Bank Five Nine Facebook page, these treats have included:

- Helping to cover the costs of hair services for women at a local salon

- Giving away 59 (in line with the bank name) pairs of tickets to the Wisconsin State Fair

- Serving as a collection site for school supplies for students who need them

- Celebrating customers’ personal milestones, such as holding an offsite lunch for a “birthday girl” celebrating 100 years

The effort has strengthened the bank’s presence and relationships within the community.

“People are shocked that we’re just out doing these random acts of kindness, without any strings attached.

And we’ve garnered a number of accounts because of it, too.

It’s been a team effort, and it’s been a perfect fit for me. It’s been a lot of fun,” he says.

Embracing Banking’s Future: Technology and Growth at Bank Five Nine

Schneider acknowledges the challenges posed by an aging customer base in Wisconsin and the need to adapt to the next generation’s banking preferences. Bank Five Nine has been proactive in integrating technology and programs that appeal to younger customers while maintaining strong relationships with existing clients. “We upgraded our mobile banking platform in the past year to a more robust platform than we had, with many more tools to manage finances. This was something the younger generation had been requesting,” he explains.

Despite the evolving banking landscape, Schneider remains optimistic about Bank Five Nine’s future. The bank operates in an affluent market with significant economic growth, providing a solid foundation for continued success.

Schneider emphasizes the importance of stable funding and the bank’s commitment to serving its community without overt tactics to market its financial products. His leadership style, rooted in treating employees like family and engaging with the community, has positioned Bank Five Nine for ongoing growth and success in the local financial services industry.

We are always looking for industry leaders to profile. If you are interested in being featured, then contact Banking+ today!