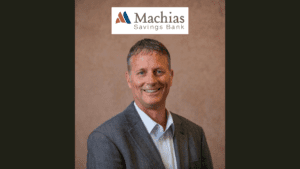

Robert Kowalski, a 62-year-old attorney and housing developer, was sentenced to 25 years in federal prison for his involvement in a multimillion-dollar embezzlement scheme that led to the 2017 collapse of Washington Federal Bank for Savings.

Robert Kowalski Sentenced for Role in Washington Federal Collapse

According to charges, Kowalski rerouted more than $8 million from the bank, disguising the funds as loans. The court ordered him to pay $7.2 million in restitution to the FDIC and $424,047 in back taxes to the IRS.

During sentencing, Kowalski expressed distress, saying, “It’s too much for me,” according to the Chicago Sun-Times. U.S. District Judge Virginia Kendall criticized Kowalski’s lack of accountability, stating, “You have never, ever accepted any role in this offense. You are absolutely incapable of looking at the reality of this situation and your role in it.”

Collapse of WaFd Bank

Washington Federal, a Chicago-based bank, was shut down in December 2017 after regulators discovered widespread fraud. The embezzlement scheme, which began in 2010, was uncovered after the death of the bank’s president and CEO, John Gembara. His passing was officially ruled a suicide, but his widow contested the conclusion.

Kowalski, a close associate of Gembara, argued that he was being unfairly blamed for the CEO’s actions. He accused Gembara of running a Ponzi scheme and claimed bank employees signed documents in his name without his knowledge. Judge Kendall, however, dismissed his claims, calling him “delusional” and accusing him of building a “façade to hide [his] liability.”

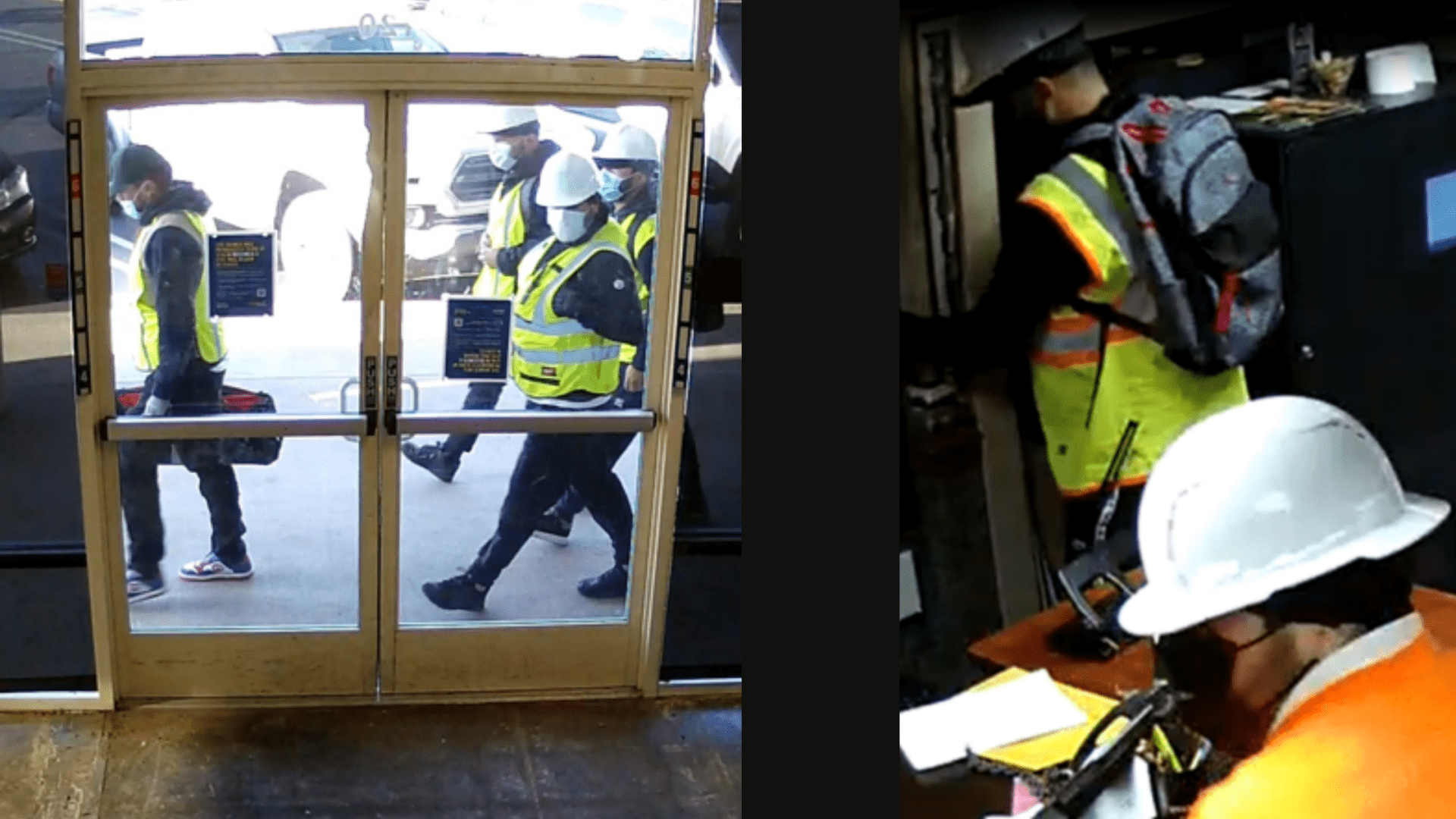

16 Indicted in Connection with Washington Federal Scandal

The unraveling of Washington Federal began years earlier. In 2011, the bank’s CFO, Barbara Glusak, raised concerns about suspicious records tied to Kowalski. She reported them to the bank’s board and later to the U.S. attorney’s office. No action, however, was taken until 2017, when federal regulators uncovered the fraudulent activities during an audit.

Kowalski is the 16th person charged in connection with the bank’s collapse. Others implicated include former Chicago City Hall official William Mahon and former Alderman Patrick Daley Thompson.

Members of both Kowalski’s and Gembara’s families were also involved in the scandal. Kowalski’s sister, Jan, was sentenced to 37 months for helping him conceal assets during bankruptcy, while his brother, William, confessed to embezzling $190,000 from the bank. Gembara’s sister, Janice Weston, was sentenced to three months for altering records to deceive regulators.

Chicago Financial Community Still Struggling from Bank Scandal

Since Washington Federal’s closure, the FDIC has recovered approximately $50 million of the $140 million it spent to cover bad loans issued by the bank. Despite the ongoing investigation, many questions remain unresolved, including the full extent of the fraud and the true nature of Gembara’s death. Kowalski’s sentencing marks a major step in accountability, but the scandal continues to cast a shadow over Chicago’s financial community.

For more in-depth coverage of the Robert Kowalski’s role in the embezzlement scheme, visit Banking Dive.