The Hidden Dangers of Unsubscribe Links in Banking Cybersecurity

Deep in the pressure of a busy morning, a financial services provider (a commercial loan officer, for example) receives an email from what appears to be a financial-services-oriented publisher.

Upon opening it, the banker is informed about a terrific opportunity. At no cost, he or she has been auto-subscribed to a monthly e-publication jam-packed with industry insights and expertise. The publishers promise ongoing access to finely detailed knowledge that will grow your career in banking, boost sales, and increase customer satisfaction.

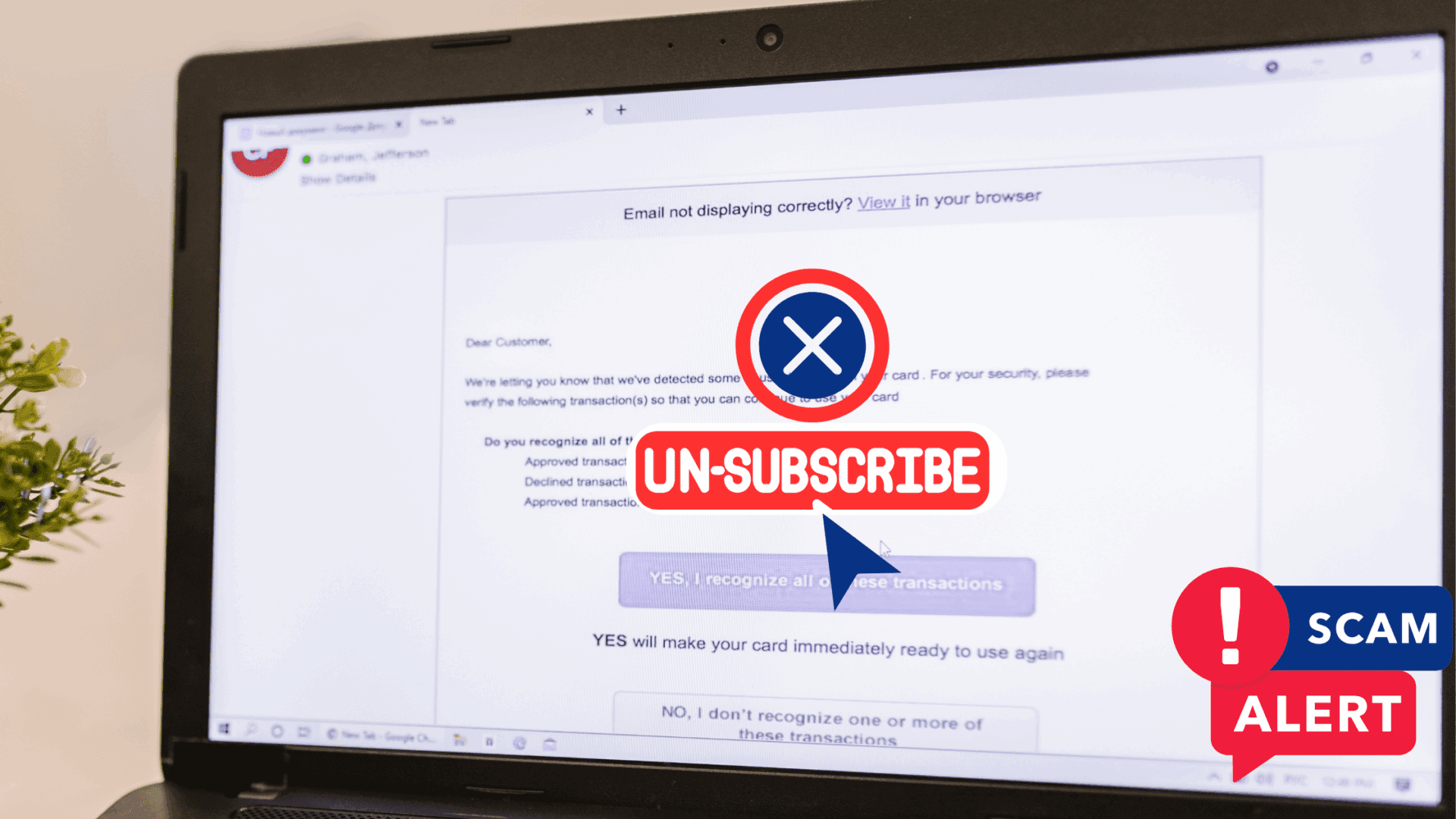

After some consideration, however, the employee decides to decline the subscription offer. To opt out, he or she clicks “unsubscribe” within the email, ceasing the receipt of all further issues.

Having cleared one more piece of inbox clutter and the pressure to read it, the banker returns to work.

What actually occurred, however, could have introduced a significant security vulnerability to the organization.

Unsubscribe Scams: How One Click Confirms Your Email

New York cybersecurity expert Joseph Steinberg, in an interview with WPIX, warns about the implications of one simple click. “If an email is aimed to scam you,” he cautions, “the unsubscribe button might be a way for fraudsters to access your information.

“There are legitimate parties that utilize an unsubscribe button [that] will unsubscribe you,” he continues. “But … there are also parties who are scammers, who use that to confirm your email address is correct.”

“The worst possible thing you could do if someone is a real spammer is to tell someone that yes, this email address is valuable, and this is a real person.

“Your email address just became much more valuable to them.”

Unsubscribe Links: A Gateway to Malware and Phishing Scams

Many professionals view the unsubscribe link at the bottom of marketing or unwanted emails as a harmless way to stop future messages. As reported by the international tech-centric publication Tom’s Guide, however, these links can trigger malware downloads or redirect users to phishing pages, sites seemingly legitimate but actually malicious.

Similarly, HotHardware quoted cybersecurity experts who warned that once users click such links, they’re leaving the secure “walled garden” of their email client and landing on the open web. On the open web, threat actors await.

How Scammers Use Unsubscribe to Validate Targets

Mohamed Elragal from SecurityOnline highlights that scammers use unsubscribe clicks to confirm emails are active. Roughly one in every 644 unsubscribe clicks leads to a malicious site. The Wall Street Journal echoed the warning, noting that clicking may signal to attackers that the account is monitored, making it a more attractive target for follow-on attacks.

Malware, Data Breaches, and Extortion: Not Just Spam

Forbes adds another angle: unsubscribe links in phishing campaigns may imitate trusted brands and steal login credentials or implant malware, leading to serious data breaches.

CyberGuy.com outlined potential consequences—ranging from spyware infections to identity theft—that can follow, simply from confirming an email address is active.

How to Safely Unsubscribe (and Avoid Email Scams)

In light of these threats, the online sources above are in consensus in their recommendation of the following defenses:

- Avoid clicking unsubscribe links in emails from unknown senders. Instead, block or report the sender as spam

- Report suspicious emails to the bank’s IT department and follow the established protocols for next steps

- Employees at smaller institutions (or employees working remotely) may have to be more proactive. In these instances, particularly when protocols are absent, bank employees should consider the following tactics:

- Use the ListUnsubscribe header in the email client. Gmail, Outlook, and Apple Mail detect legitimate opt-out requests embedded in headers, keeping users inside a safe environment

- Go straight to the source. If you remember subscribing to a given service, log into that website or portal directly and remove yourself via account settings

Banking Security: The Increased Threat of Phishing and Unsubscribe Fraud

Phishing remains a top threat vector, targeting banks, financial firms, and their employees. Wired reports that 200,000 new phishing sites appear each month, with the FBI listing phishing as the top cybercrime, staying updated on current scams affecting bankers is essential.

Clients trust financial institutions with their money and personal data; even a single credential stolen via malware can snowball into insider access, wire fraud, or stolen funds. Though seemingly harmless, the unsubscribe link scam can serve as a gateway for threat actors to initiate multi-stage attacks like spearphishing, account takeover, or ransomware.

Strengthening Bank Cybersecurity Against Unsubscribe Scams

Banks and financial services firms should treat this risk as part of their cyber hygiene protocols:

- Train employees to perceive unsubscribe links cautiously, especially in unsolicited emails

- Incorporate unsubscribelink scams into phishing simulations—formal drills to gauge employee vigilance

- Enforce email gateway rules to strip or sandbox unsubscribe links from unknown domains.

- Encourage use of listunsubscribe features rather than in-body links

- Promote the use of email aliases and disposable addresses when engaging vendors or subscribing for trials

Think Before You Click: Avoiding Unsubscribe Cyber Threats

The next time a team member clicks unsubscribe on a suspect message, it may do more harm than good. Clicking can pull users out of the secure confines of their email client into a dangerous digital landscape, where phishing threats thrive.

By adopting the safeguards above, financial professionals can maintain clean inboxes without opening attack vectors.