JPMorgan’s $175 Million Lesson Reframes Due Diligence for Bank Executives.

American entrepreneur Charlie Javice’s recently adjudicated seven-year sentence serves as a caution for bank risk and compliance teams: accepting unverified data or relying on surface-level diligence can expose financial institutions to costly fraud, regulatory penalties, and reputational harm.

Press coverage from sources including Reuters reports that JPMorgan relied on Javice’s representations and then discovered, too late, via post-acquisition audits, that the startup’s prized customer database had been fabricated.

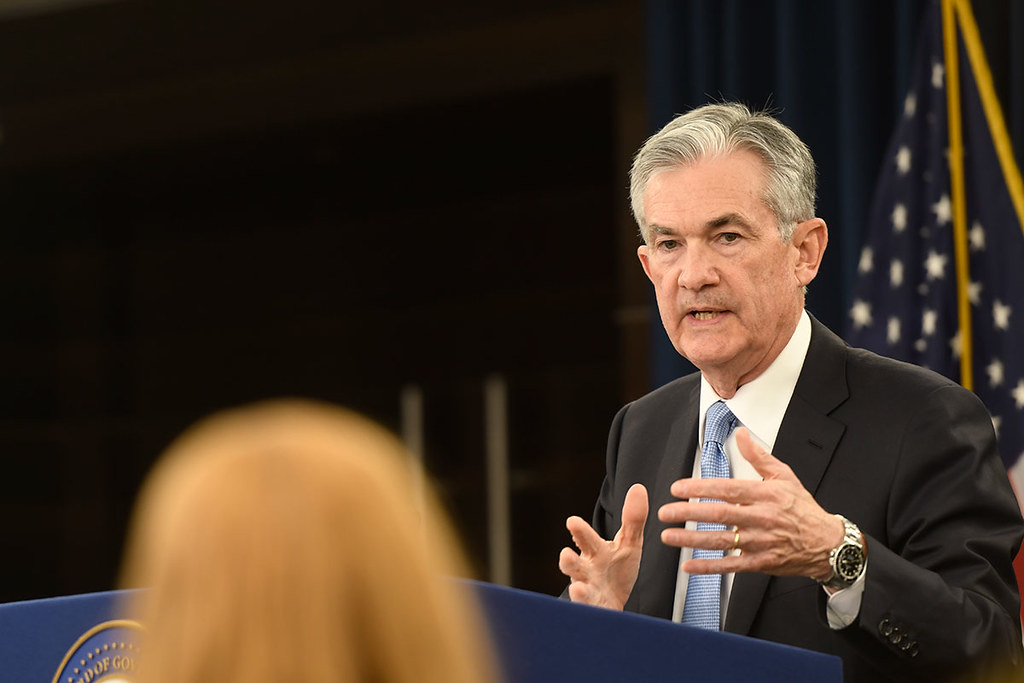

Forbes has noted that legal experts — including the presiding judge and analysts from academic journals and industry trade publications — have highlighted this case as a stark warning. Even the largest institutions cannot take founder-supplied data at face value, particularly in fintech M&A deals, where digital assets are both highly valuable and vulnerable to manipulation.

Critical Failures: Liabilities Exposed in Fintech Acquisition Due Diligence

Case investigators have cited several liabilities exploited in the scheme, as identified by the Association of Certified Financial Examiners and the blog of Qbit Capital, a Zurich venture capital firm:

- Inadequate Data Verification: JPMorgan unknowingly accepted inflated user numbers with insufficient third-party auditing and independent forensic analysis, a critical oversight given the digital nature of the deal.

- Speed Over Substance: The pursuit of a rapid deal closure displaced thorough examination of the startup’s core technology, user database, and compliance posture.

- Fintech-Specific Blind Spots: Traditional bank M&A teams sometimes underestimate the complexity and risk digital-first companies bring to the table, missing nuances that might be routine in other sectors.

Reengineering Risk Controls: Actionable Frameworks for Fintech M&A

Industry experts offer practical steps to prevent fintech M&A fraud, drawing on insights from a range of global sources.

Comprehensive Third-Party Data Verification

SaaS solutions provider Diligent (Tokyo) emphasizes that self-reported data should never be taken at face value. Independent analysis and periodic benchmarking against market standards are essential, particularly when reviewing user counts, transaction histories, and digital customer databases.

Strengthening Internal Controls with Technology

According to information host M&A Community (London), advanced analytics — including AI-powered tools — can significantly enhance internal fraud detection. These technologies help validate digital assets and flag unusual patterns without relying solely on vendor testimony, streamlining risk assessment in complex deals.

Cross-Functional Diligence Teams and Continuous Monitoring

Miller Cooper (Chicago) and law firm Wilson Sonsini (Palo Alto, Calif.) both note that robust diligence requires cross-functional teams with expertise across compliance, technology, legal, and risk management. Each team member should validate a specific segment of the deal, while risk assessments are revisited at regular intervals post-acquisition to catch discrepancies as new information emerges.

Mandating Regulatory and AML/KYC Compliance Reviews

Due diligence must include thorough regulatory reviews, covering anti-money laundering laws, consumer protection frameworks, data privacy standards (GDPR, CCPA), and sector-specific licensing or reporting requirements.

Fostering a Culture of Skepticism and Accountability

Senior bankers should promote a culture of skepticism and accountability. Annual training, clear whistleblowing policies, and segregation of review responsibilities prevent internal complicity and ensure no single person can override controls.

Immediate Action Items for Risk Teams

Toronto professional services firm BDO Canada offers actionable takeaways for banks responding to this fraud. Its best-practice recommendations have been amalgamated with advisory and legal sources cited above and are intended as general guidance rather than attribution to any single information provider:

- Mandate Direct Access to Core Data

Banks must insist on direct access to a target’s proprietary data, including user databases and transaction logs, rather than relying on third-party validations. JPMorgan’s reliance on fabricated data, which was externally validated and subsequently deleted, demonstrates the risk of indirect verification. Direct access enables thorough forensic analysis and reduces the potential for data manipulation. - Implement Rigorous Data Sampling and Testing

Randomized sampling and testing of a target’s data can reveal inconsistencies and potential fraud. In the Frank case, discrepancies were uncovered when a marketing campaign to 400,000 supposed users generated unusually low engagement, indicating inaccurate data. - Enhance Cross-Functional Due Diligence Teams

Teams of compliance, technology, legal, and risk management experts ensure comprehensive evaluation of potential acquisitions. This approach helps identify sector-specific risks and promotes holistic assessment of operations and compliance posture. - Prioritize Regulatory and Compliance Audits

Thoroughly vet a target’s adherence to regulatory requirements, including anti-money laundering laws, data privacy standards, and industry-specific regulations. Oversights can expose banks to legal and reputational risk, as seen in the Frank acquisition aftermath. - Foster a Culture of Skepticism and Accountability

Encourage skepticism and accountability within due diligence teams to prevent oversight and complacency. Regular training, clear whistleblower policies, and segregation of duties help detect and prevent fraud during acquisitions.

Integrating these strategies into due diligence processes can help banks safeguard against risks highlighted by the Frank acquisition and support more informed, secure investment decisions in the digital banking era.