In the intricate world of financial oversight, the Financial Crimes Enforcement Network (FinCEN) stands as a bulwark against illicit financial activities, money laundering, and terrorism financing. Its recently published Year in Review for FY 2023 encapsulates its comprehensive effort to safeguard the U.S. financial systems.

FinCEN’s Approach to Financial Security

FinCEN’s mission is clear:

- Protect the financial system from illegal use

- Combat money laundering and related crimes

- Enhance national security through strategic financial intelligence operations

The bureau executes this mission through meticulous collection, analysis, and dissemination of financial intelligence, which informs and supports law enforcement agencies.

FinCEN Leverages Bank Secrecy Act (BSA) for Powerful Results

The cornerstone of FinCEN’s efforts is the Bank Secrecy Act (BSA).

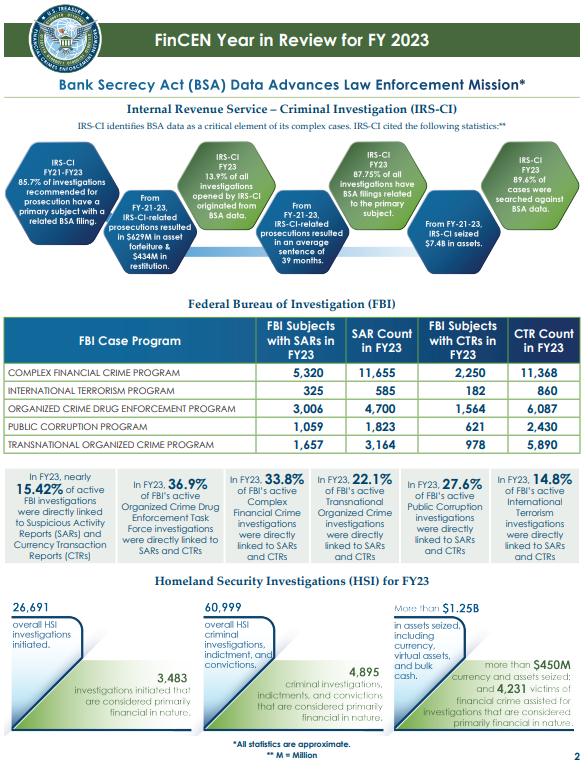

In FY 2023, BSA data played a pivotal role in advancing law enforcement missions. The Internal Revenue Service’s Criminal Investigation division (IRS-CI) and the Federal Bureau of Investigation (FBI) have both highlighted the critical importance of BSA data.

For instance, nearly 15.42 percent of FBI investigations were linked directly to Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs), underscoring the vital role of these tools in tackling complex financial crimes, international terrorism, organized crime, and public corruption.

FinCEN’s Vast Reporting Network

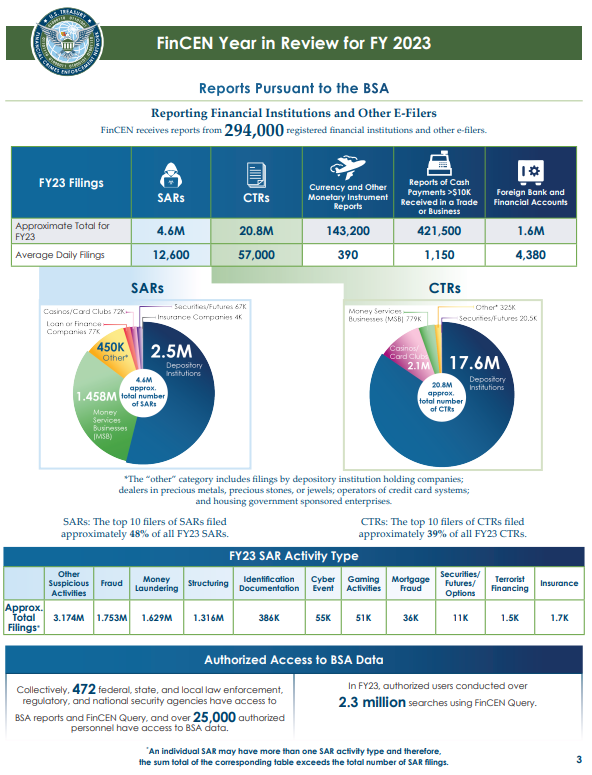

FinCEN receives reports from an impressive network of 294,000 registered financial institutions and other e-filers. In FY2023 alone, the agency processed approximately 4.6 million SARs, 20.8 million CTRs, and numerous other reports, demonstrating the sheer volume of data it manages.

Notably, the top ten filers of SARs and CTRs accounted for nearly half of all submissions, highlighting the concentration of activity among major institutions.

FinCEN’s Information Sharing Advantage

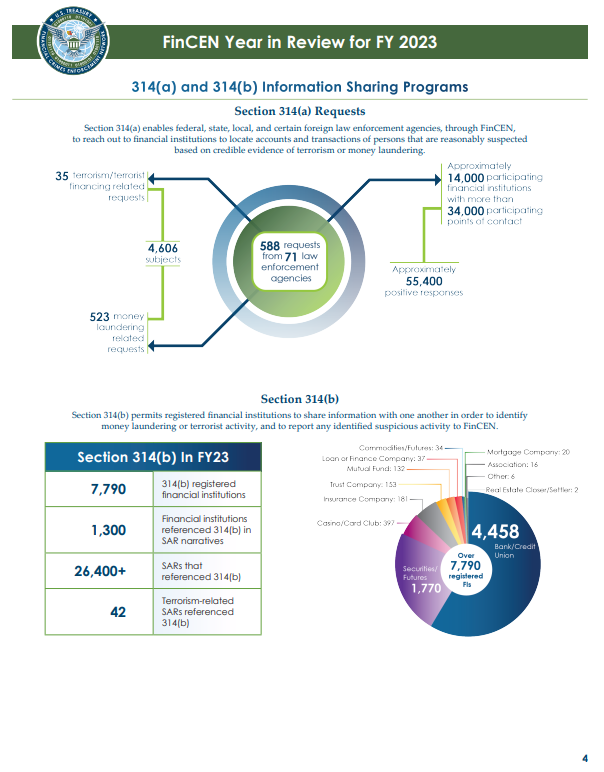

One of FinCEN’s strategic advantages lies in its ability to facilitate information sharing. Section 314(a) requests enable law enforcement to reach out to financial institutions to identify transactions and accounts linked to suspicious activities.

In FY2023, this mechanism proved invaluable, with over 26,400 SARs referencing 314(b) information sharing, which allows institutions to collaborate on identifying money laundering and terrorist activities.

The Impact of BSA Data

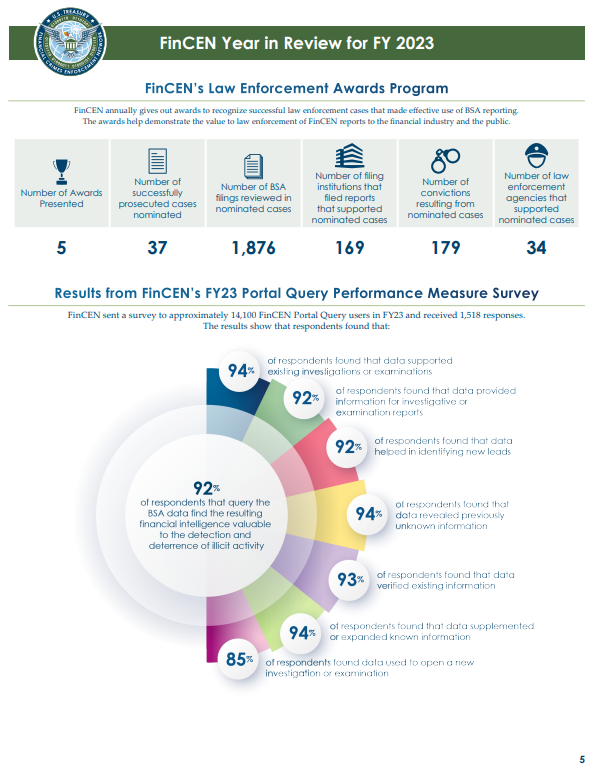

FinCEN also celebrates the successes of law enforcement agencies, highlighting cases that effectively utilize BSA reporting. In FY2023, five awards were presented, acknowledging 37 successfully prosecuted cases that relied on meticulous BSA data analysis.

Advancing Knowledge and Security

Empowering Financial Institutions: FinCEN’s Training and Guidance Programs

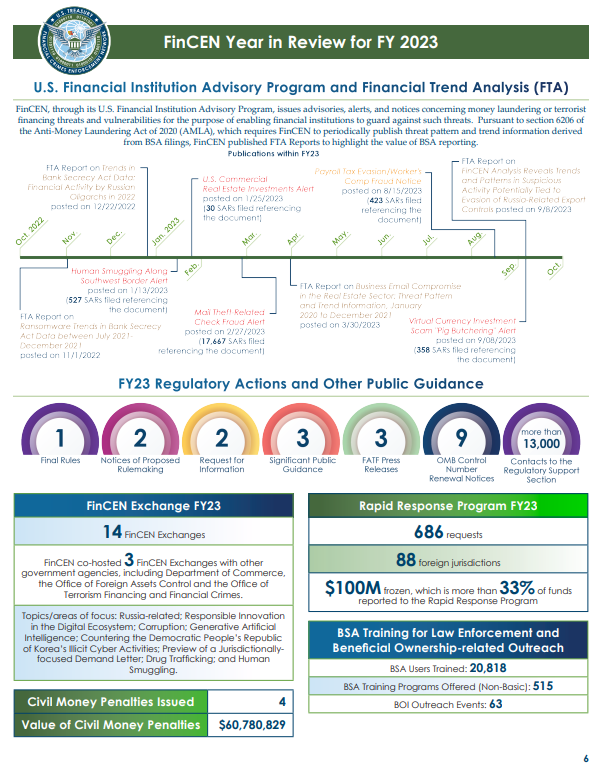

Through the U.S. Financial Institution Advisory Program and Financial Trend Analysis (FTA), FinCEN provides crucial advisories, alerts, and notices to financial institutions, helping them guard against emerging threats. This initiative is part of a broader effort to keep institutions informed and prepared against money laundering and terrorist financing risks.

The FinCEN Exchange Program

The FinCEN Exchange Program is also a noteworthy example of public-private collaboration, bringing together:

- Law enforcement

- National security agencies

- Financial institutions

- Private-sector entities

These partnerships aim to combat financial crimes more effectively by enabling better risk identification and providing critical information to disrupt illegal activities.

Rapid Response and Training Initiatives

FinCEN’s Rapid Response Program

FinCEN’s Rapid Response Program (RRP) is another vital tool, designed to help victims of cyber-enabled financial crimes recover stolen funds. In FY2023, this program facilitated the freezing of $100 million across 88 foreign jurisdictions, showcasing its global reach and impact.

Moreover, FinCEN strongly emphasizes training, with more than 20,818 BSA users bolstered by 515 programs. Its ongoing commitment to education ensures that law enforcement and financial institutions are well-equipped to tackle the evolving landscape of financial crimes.

2023 FinCEN Report: Year in Review

FinCEN’s Year in Review for FY 2023 highlights an organization deeply committed to protecting the financial system from illicit use. Through robust data collection, strategic information sharing, and strong partnerships, FinCEN continues to play a crucial role in maintaining the integrity and security of our financial systems.