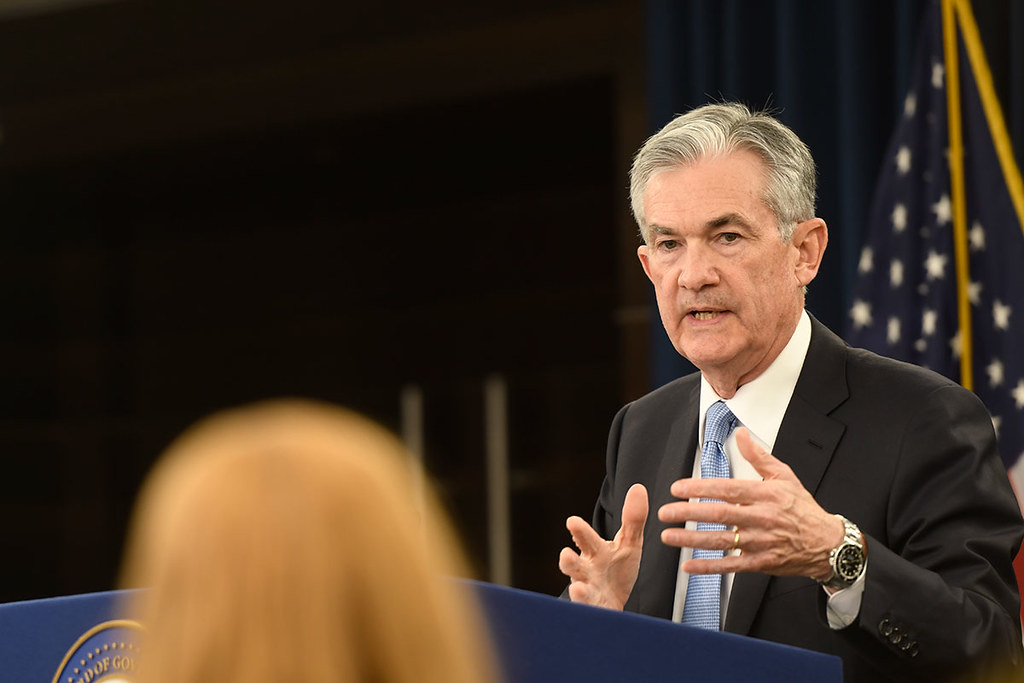

On September 18th, the Federal Reserve announced a 0.5 percent reduction in the federal funds rate, adjusting the range to 4.75–5.00 percent. Jason Schenker covered the move for Forbes.

The Federal Reserve interest rate reduction surprised some investors, and additional rate cuts are projected through 2026, as indicated by the latest forecasts from the Federal Open Market Committee (FOMC). This rate cut marks the beginning of a potentially prolonged monetary easing period aimed at stabilizing the U.S. economy amid inflationary concerns.

Federal Reserve Interest Rate Reduction Amid Inflation Concerns

The decision to cut interest rates by 0.5 percent came as a response to ongoing economic challenges, including inflationary pressures and a slowing labor market. While the CME FedWatch Tool indicated divided market expectations between a 0.25 percent and a 0.5 percent cut, the larger reduction signals the Fed’s willingness to take more aggressive steps to achieve its dual mandate: full employment and price stability. The bigger-than-expected reduction highlights the Federal Reserve’s intent to provide additional monetary stimulus to combat inflation while supporting economic growth.

This rate cut is not an isolated event but part of a broader strategy. Federal Reserve Chairman Jerome Powell and the FOMC have hinted that further reductions are likely, particularly in response to inflation trends and other economic factors. The labor market remains relatively strong, yet inflation levels, which have persisted above the Fed’s two-percent target, necessitate more action.

FOMC Projections: Rate Cuts and Economic Outlook

Alongside the rate cut, the Federal Reserve released its updated quarterly economic projections, providing valuable insights into the likely trajectory of interest rates through 2026.

These projections, displayed through the FOMC’s “dot plot” format, show individual members’ expectations for future interest rates. Compared to the previous June forecast, the September projections indicated a more dovish outlook, with further rate cuts expected in 2024, 2025, and 2026.

The FOMC’s median forecast for the federal funds rate is now expected to fall over the coming years:

- To 4.4 percent by the end of 2024

- To 3.4 percent by the end of 2025

- To 2.9 percent by the end of 2026

These numbers are lower than the June forecasts, which projected a more gradual reduction in rates. This shift in policy direction reflects the Fed’s acknowledgment of slowing economic growth and a slightly weaker labor market.

Despite these adjustments, the FOMC remains optimistic about inflationary trends. The median forecast for the Personal Consumption Expenditures (PCE) inflation and Core PCE inflation (the Fed’s preferred inflation gauges) showed improvement, although inflation is still expected to remain above the two percent target through 2024 and 2025.

Rate Cut Impact on Markets: Stocks, Bonds, and the Dollar

The 0.5 percent rate cut surprised some market participants but had been largely anticipated based on market signals, such as the 65 percent probability priced into the CME FedWatch Tool prior to the announcement. As expected, the larger-than-predicted rate cut has significant implications for the markets.

Historically, rate cuts support equities and bond prices by lowering borrowing costs and encouraging investment. This pattern is likely to continue, as the Fed’s forecasts point to further monetary easing. The prospect of additional rate cuts also weakens the U.S. dollar, making it less attractive relative to other currencies, and could encourage more capital flow into equities and bonds. Investors, therefore, see upside potential for stocks and bonds, while the U.S. dollar is expected to remain under pressure.

Powell’s Remarks and Future Rate Cut Impact on Market Strategies

While the September 18th rate cut has set the tone for future monetary policy, much attention is focused on Federal Reserve Chair Jerome Powell’s remarks during his post-decision press conference. Powell’s guidance on the timing and scale of future rate cuts will be crucial in shaping investor expectations and market strategies. His comments on inflation trends, labor market conditions, and global economic risks will provide further insight into the Fed’s strategy.

Additional details on this Fed action can be found at Forbes.