In 2023, compensation for CEOs of large and midsize U.S. banks saw a notable decline, primarily due to a significant drop in annual bonus payouts. The trend marked a reversal of two years’ increases, with median total direct compensation decreasing by 6.6 percent, according to Compensation Advisory Partners. CEOs received a 21.5 percent increase in 2021 and a seven percent rise in 2022, as reported by Allissa Kline in American Banker.

Banking Crisis Triggers 30 Percent Drop in Bank CEO Bonuses

The primary factor behind the decrease was a 30.3 percent drop in median bonus payouts among the 53 banks analyzed. This decline was driven by the financial fallout from the spring banking crisis, which saw the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank. These events forced many banks to shift their focus from loan growth to deposit retention, impacting their financial performance and bonus-related goals.

“Companies set their incentive plan goals based on a different environment, but they had to pivot and change strategy,” said Shaun Bisman, a partner at Compensation Advisory Partners. Consequently, many bonuses were down because the initial goals set at the beginning of the year were not met.

Modest Increases in Base Pay and Long-Term Incentives for Bank CEOs

Other components of CEO pay packages, such as salaries and long-term incentives, showed smaller increases. Median salaries rose by 3.1 percent, while long-term incentives increased by 3.9 percent. These lifts were modest compared to previous years and were influenced by efforts to retain top executives in a competitive job market.

“The competitive market data is generally leveling off,” noted Kelly Malafis, a founding partner of Compensation Advisory Partners. Banks’ overall financial performance in 2023, including a 12.4 percent drop in median earnings and an 11 percent decline in net income, also affected boards’ willingness to increase long-term incentive pay.

Bank CEO Pay Dive vs. S&P 500 Rise

The decline in bank CEO compensation contrasts with trends at public companies more broadly.

According to Josh Black, editor-in-chief of Diligent Market Intelligence, CEO pay packages at S&P 500 companies rose by an average of 3.3 percent in 2023, while bank CEO pay packages fell by 8.4 percent. Black attributed this disparity to the profitability challenges faced by banks in a high-interest-rate environment, whereas nonbanking companies were less affected by interest rate rises.

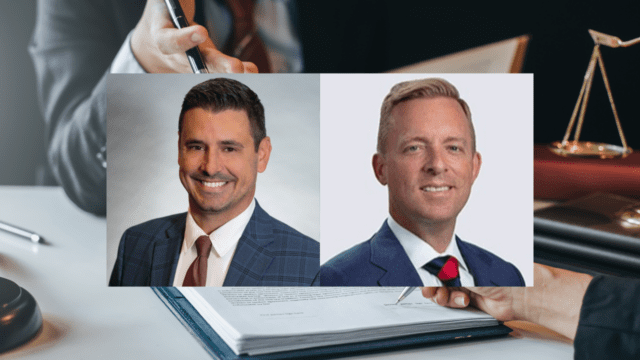

Notable Examples of CEO Bonus Reductions

Several banks reported substantial decreases in CEO bonuses. At Washington Federal Bank in Seattle, CEO Brent Beardall’s bonus dropped to zero from $1.3 million in 2022, due to the bank missing its earnings-per-share target. Despite Beardall’s six-week medical leave following a plane crash, the board opted to award other executives a 35 percent discretionary bonus under extraordinary circumstances.

Other significant declines last year included:

- United Community Bank, Greenville, S.C., where CEO H. Lynn Harton’s bonus decreased by 66 percent

- Comerica, Dallas, Tx, where CEO Curtis Farmer’s bonus fell by 62 percent

- Bank of Hawaii, Honolulu, where CEO Peter Ho’s bonus was reduced by 70 percent, attributable to a 25 percent fall in earnings per share.

For the full coverage of 2023’s salary cuts to bank CEOs, read the original American Banker article.