In a recent federal indictment, four individuals allegedly conned Minnesota credit unions and banks out of nearly $500,000 through a sophisticated scheme involving fraudulent check deposits and withdrawals at interactive teller machines (XTMs).

The case highlights the critical role that social media recruitment can play in orchestrating a scam of this type, as reported by journalist Stephen Montemayor in the StarTribune.

The setup, which lasted from November 2021 to March 2022, involved depositing over 150 fake checks at XTMs in the Twin Cities area. Primarily targeting Wings Financial Credit Union, the defendants reportedly used fraudulent accounts to withdraw more than $200,000. They engaged in similar criminal activities at other financial institutions, including Affinity Plus Credit Union and Huntington Bank, netting an additional $150,000.

The Overnight ATM Heist: Exploiting the XTM Advantage

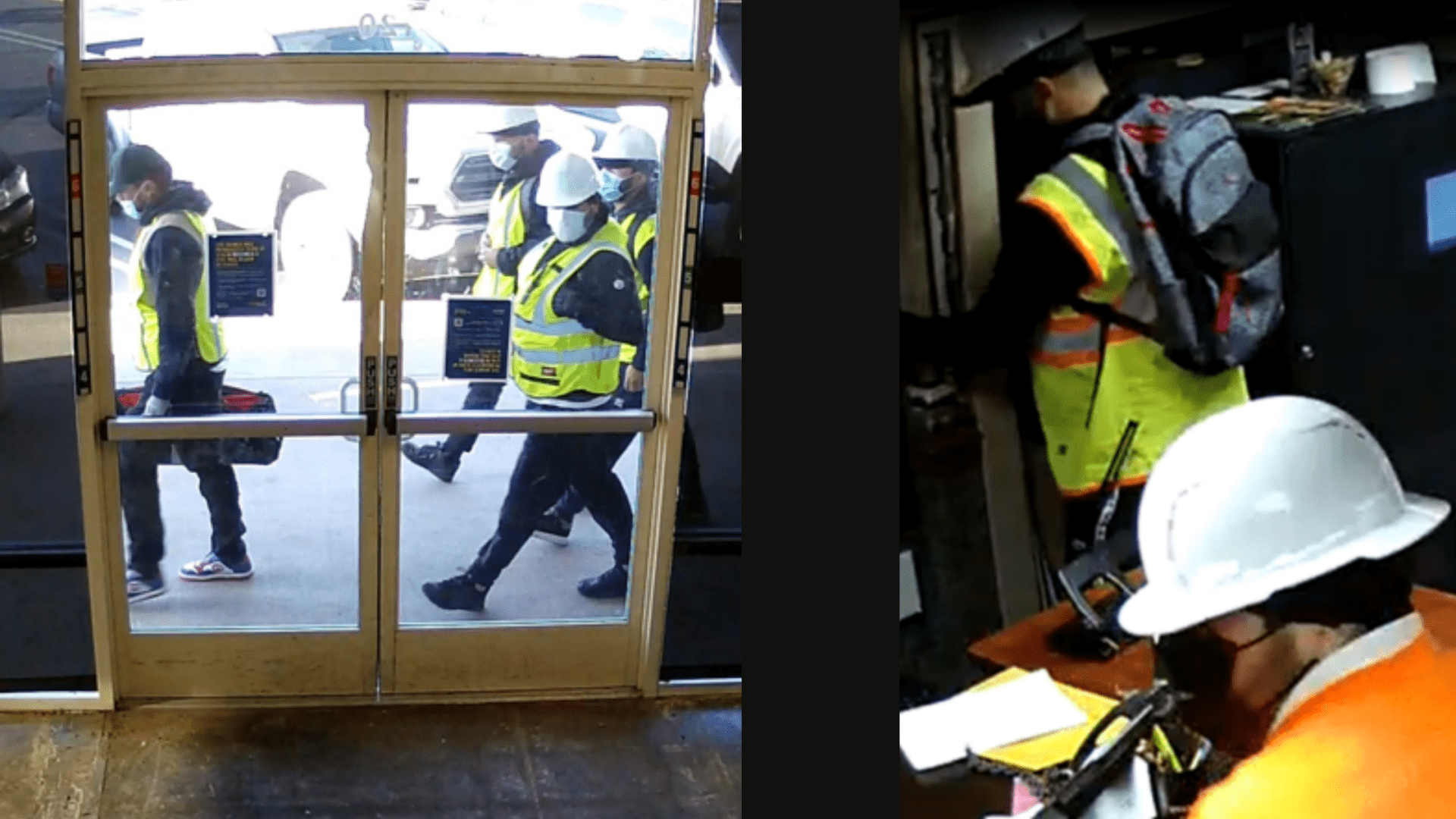

According to the indictment, Cornelius Anthony McDade, 32, of Minneapolis, and three other yet-unapprehended accomplices orchestrated this scheme using Wings’ advanced XTMs.

Unlike standard ATMs, XTMs allow users to deposit checks and withdraw cash immediately without a clearing delay, thus enabling fraudsters to access significant funds before checks are processed. The loophole was exploited during overnight transactions on weekends, with the perpetrators strategically timing their activity to evade detection until the following business day.

The Role of Social Media in Modern Bank Fraud

Social media proved essential to the scheme’s success.

Prosecutors allege that the suspects leveraged social media platforms to recruit co-conspirators, persuading them to open accounts for fraudulent purposes. Additionally, the perpetrators stole existing debit cards and checkbooks from local Twin Cities residents, further broadening their access to funds and creating more channels for illicit withdrawals.

The role of social media in this case reflects a growing trend in bank fraud schemes, with recent examples demonstrating the ease with which social platforms can serve as conduits for illegal activities.

Last month, viral TikTok videos documented users across the country trying to exploit a purported “bug” at Chase ATMs, leading them to believe they could access funds without depositing equivalent amounts. Many users unknowingly committed fraud in the process, underscoring the influence of viral misinformation.

Protecting Against the Next Wave of Bank Fraud

Strengthening ATM Security

For financial institutions, the vulnerabilities that enabled this scam highlight some compelling responses. They include the need to not only fortify technical safeguards at teller machines but also actively monitor social media for emerging fraud trends.

Monitoring Social Media for Threats

The viral nature of social posts on platforms like TikTok demonstrates how quickly misleading or harmful practices—especially those aimed at banking systems—can spread. Implementing controls that detect patterns associated with social media scams, such as multiple new account openings linked to common addresses or repeated deposits of large checks with immediate withdrawals, could help mitigate similar fraud attempts.

Educating Customers on Fraud Prevention

Takeaways resulting from this case include calls for increased vigilance within the financial services industry, especially as technology and social media evolve. Interactive teller machines, designed to enhance user experience, also present unique vulnerabilities that fraudsters are eager to exploit. To combat this, financial service providers should proactively educate customers on safe banking practices, invest in advanced fraud detection, and collaborate closely with law enforcement to track social media-related schemes.

Advanced Security Measures for the Digital Age

The Minnesota indictment serves as a sobering reminder for bankers to take a multi-faceted approach to bank security. This includes incorporating advanced technology and closely monitoring both financial transactions and the social media landscape to anticipate and neutralize fraud risks.

Learn more about the federal indictments of bank fraudsters that allegedly exploited ATM loopholes with social media recruitment in this detailed report from the StarTribune.