As the second half of 2024 unfolds, Ben Crowley—Managing Director of The Kafafian Group, Inc., Bethlehem, Pa.—sees market forces that underscore the analytic advantages of a profitability measurement system, especially for community banks.

Key Market Trends Shaping Community Bank Profitability in 2024

Crowley identifies the following influences:

Post-COVID Recovery

- Community banks continue to adopt technology and adjust operations post-pandemic to meet changed customer behaviors, focusing on granular profitability analysis.

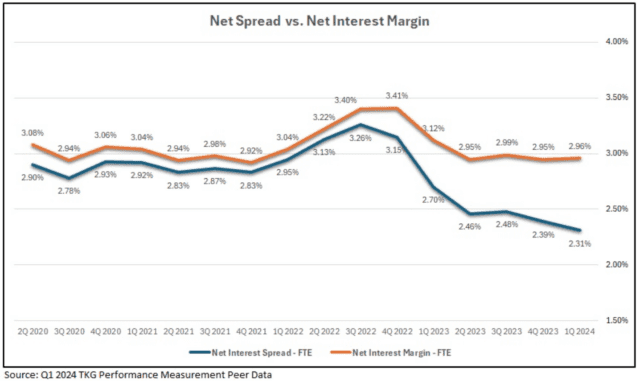

Higher-for-Longer Rate Environment

- Banks are managing spread compression in a high-interest rate environment by measuring net interest spread and optimizing operations.

Regulatory Attention:

- Regulators now emphasize detailed profitability metrics alongside traditional concerns, influencing strategic decisions and operational efficiency.

Detailed Profitability Methods:

- Banks are implementing comprehensive cost analysis, funds transfer pricing, and performance trend analysis to optimize profitability and strategic planning.

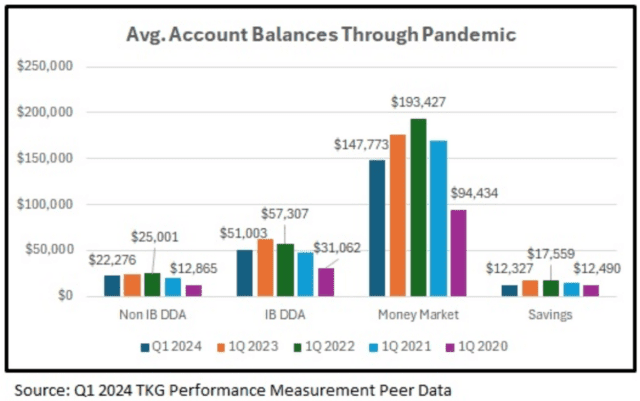

Declining Average Balances:

- Deposit balances are decreasing, prompting a focus on acquiring new depositor relationships to counter rising funding costs and shortened liabilities.

Strategic Alignment

- Linking detailed financial performance with strategic goals ensures banks direct resources effectively towards long-term success and competitive edge.

Technological Advantages of Profitability Measurement Systems for Community Banks

Crowley cites numerous advantages for banks that employ and leverage a profitability measurement system.

He notes that the technology—which measures financial productivity at the branch, line of business, and product levels—integrates comprehensive cost allocation methodologies and funds transfer pricing to navigate challenges like margin compression and regulatory scrutiny.

Further, Crowley explains that the capability’s approach aims to enhance operational efficiency, identify growth opportunities, and ensure strategic alignment with long-term goals through detailed performance analysis over multiple quarters.

Crowley’s online analysis of community-banking’s benefits of profitability measurement systems can be found on The Kafafian Group’s site.