Pawnshops, often overlooked in discussions of predatory lending, embody many of the same risks as payday loans. With loan offers that can vary dramatically for the same item, they highlight the unpredictable and often exploitative nature of short-term lending to vulnerable populations, according to Zachary Crockett’s analysis in The Hustle.

How Pawnshop Loans Work

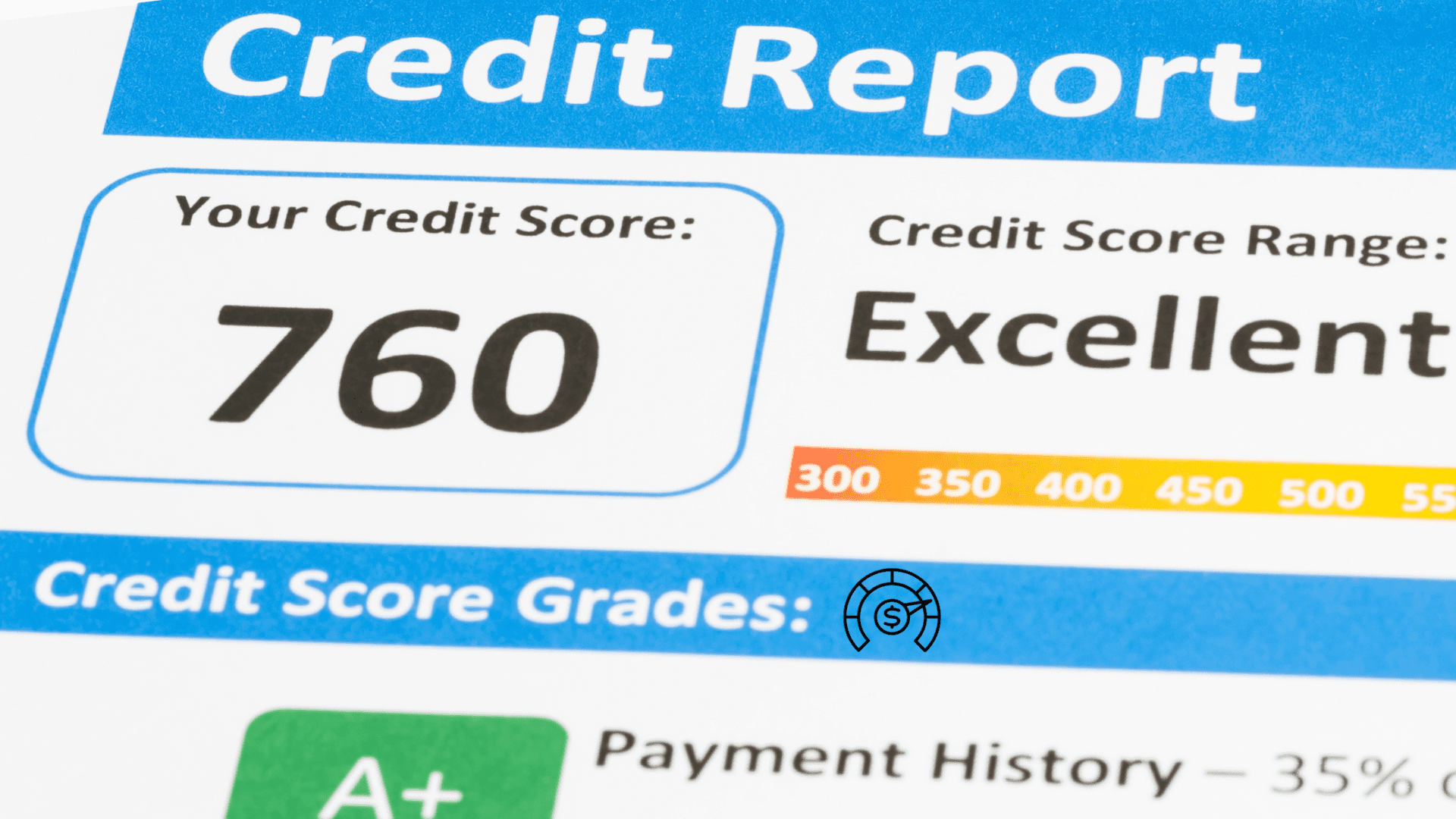

Pawnshops offer loans by holding items as collateral, typically lending 40–60 percent of the item’s retail value. A borrower might pawn a $200 gold watch for a $100 loan, with 30–90 days to repay it, often at interest rates ranging from 2–25 percent per month.

Pawnshop Interest Rates & Regional Variations

Those rates, however, vary regionally. In California, for example, the monthly limit is 2.5 percent (30 percent APR). In Alabama, however, it is 25 percent a month (300 percent APR), bordering on predatory.

The Risks of Pawnshop Loans

Regardless of the rate, failure to repay means the pawnshop keeps and sells the item.

These high interest rates, coupled with the short-term nature of the loans, can quickly become burdensome for lower-income individuals who make up the majority of pawnshop customers. The National Pawnbrokers Association reports that while 7.4 percent of U.S. households have used a pawnshop, this figure jumps to 40 percent among lower-income earners.

Pawnshop Loans: A Cycle of Debt

A stark example of this burden is Christine Luken, who pawned her grandmother’s ring for $150. Over 24 months, she paid $720 in interest—480 percent of the original loan. This outcome illustrates how these “quick fixes” can become long-term financial traps.

Why Pawnshop Offers Vary so Much

An experiment by PawnGuru highlights the unpredictability of pawnshop offers. Four items were taken to different pawnshops in Houston, and the offers varied significantly:

- One-carat diamond (resale value: $2,500)

-

- Highest offer: $1,400

-

- Lowest offer: $200

-

- Variance: 600 percent

- 2005 Kawasaki motorcycle (resale value: $2,000)

-

- Highest offer: $1,400

-

- Lowest offer: $800

-

- Variance: 75 percent

- Louis Vuitton handbag (resale value: $535)

-

- Highest offer: $300

-

- Lowest offer: $200

-

- Variance: 33 percent

- 500GB PlayStation 4 (resale value: $175)

-

- Highest offer: $110

-

- Lowest offer: $75

-

- Variance: 46 percent

Factors Driving Pawnshop Offer Variations

These discrepancies are common and are driven by factors such as:

- Differing profit margins

- Available capital

- Each shop’s specialization

In that latter case, for example, a shop specializing in jewelry might undervalue a rare guitar, while one focused on electronics might misjudge a Cartier watch.

The Pawnshop Debt Trap

The combination of high interest rates and varying offers can trap borrowers in a cycle of debt. Many customers repeatedly pawn the same items, paying interest each time, which benefits the pawnshop but can severely harm the borrower’s financial health.

Pawnshops, with their inconsistent valuations and high interest rates, are a significant part of the predatory lending ecosystem. While they offer quick cash, the long-term costs can be severe for those already in financial distress.

That caveat, however, isn’t meant to impugn all pawnshops.

Humane Approach to Pawnshop Lending

Jimmy Rodriguez, a shop owner in Houston, sometimes adopts a softer approach to the collateral he handles.

“If I know an item means something special to a customer, I’ll work to get it back to them,” he says. “Especially if it’s, like, a wedding ring.”

The complete analysis of pawnshop lending is at The Hustle.