Why Bankers Play Golf: Myth, Tradition, and the Greens of Business

It’s a Tuesday morning in a community bank branch, and the phones are ringing off the hook. A teller goes looking for their commercial lender because one of their customers has a question. “Not here,” comes the reply from a colleague. “Took a client golfing. Just tell them they are all booked with back to back meetings and they will call them back as soon as they can. Maybe tomorrow morning.”

The words hang in the air. To those grinding through their day, that disclosure can sound like an out-and-out perk: a day away from spreadsheets, P&Ls, global cash flows, all traded for tee shots. In an industry where every hour is measured in output, an afternoon on the fairway might look like a leisurely vacation day during a branch’s busiest crunch time.

Myth vs. Reality: An Extension of the Office

But in banking (especially smaller community banks and credit unions), appearances can be deceiving. For many client-facing executives, the golf course is less an escape than an extension of the office. It’s one of the few places where business conversations can unfold naturally, trust can be tested in real time, and relationships can deepen in ways the four walls of a branch can’t always accommodate.

Golf and banking: a pairing as seemingly natural as coffee and donuts. But why has this sport — slow-paced, equipment-heavy, and often prohibitively expensive — become so synonymous with the financial services crowd? Why is there confusion among those in banking as to golf’s true value? Is the cliché of the deal-making, fairway-striding banker rooted in fact, or is it an outdated stereotype?

The answer lies in a blend of history, perception, and enduring business dynamics.

From Clubhouse to Corner Office

The association between golf and white-collar professionals, including bankers, dates back more than a century. As reported by Forbes, “golf became the sport of business because it encouraged extended face time in a relatively private, distraction-free environment.” Four hours on the course offers ample opportunity for trust-building, casual negotiation, or even subtle vetting of a potential hire or client.

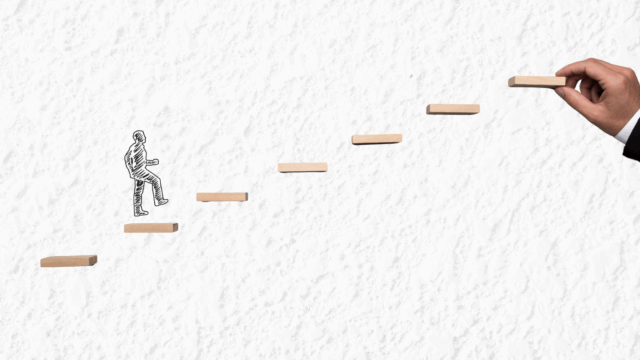

For Andrew Rietz, Managing Director of Financial Institutions at My Private Shares, that concept is more than theory — it’s personal experience. “From one round of golf, you can build a relationship that lasts a decade,” he says, recalling a Maryland Bankers Association outing that led to multiple follow-up games and an enduring friendship with two executives he met by chance.

What Golf Reveals About a Client

Banking, especially on the commercial and private wealth sides, is a relationship business. Building rapport outside the office — especially in a setting where patience, temperament, and composure are on full display — has long been considered a differentiator.

As noted by Harvard Business Review, “golf reveals character.” Miss a short putt or slice a drive into the woods, and you quickly learn who maintains poise under pressure and who doesn’t.

Rietz agrees that golf’s real value lies beyond the scorecard. “It’s a character game. You celebrate great shots together, you laugh off the ones that go into the woods. You learn who people are without them having to tell you,” he said. That observational insight, he adds, “can be as important as anything said during the round.”

Old-School Tradition Meets New-School Networking

To younger bankers or fintech professionals, the notion of golf-as-business-mandate can feel passé. They represent a new generational shift in banking networking, where time is valued differently than in a traditional setting. This is partly because the sport has a diversity problem. According to the National Golf Foundation, only 21 percent of U.S. golfers in 2023 were non-white, and women accounted for just 25 percent of adult players — both improvements from a decade earlier, but still reflective of golf’s country-club image.

Yet Rietz says the enduring appeal isn’t about exclusivity, but about proximity and time. “In a four-hour round, especially if you’re riding in a custom golf cart, you’re in close quarters with someone. You’re sharing the same space, the same pace. There aren’t many environments in business where you get that kind of uninterrupted time.”

Meanwhile, American Banker recently profiled rising executives who see leadership-building in different forms: community organizing, local volunteerism, and mentorship. Few mentioned golf as their primary networking tool.

Still, there’s little denying that within certain segments of the banking world — especially private banking, wealth management, and commercial lending — golf maintains its grip as a social and professional glue.

Banking’s Cultural Carryover

The perception of golf as a banker’s sport persists in part because of how institutions portray themselves. Sponsorships of golf tournaments, executive team photos on club lawns, and internal outings to local courses reinforce the connection. It’s common to find annual lender-retreats built around a “captain’s choice” scramble, or client appreciation days at regional courses.

Rietz notes that outsiders sometimes assume bankers on the course are “goofing off.” In reality, he says, it’s work of a different kind.

You’re representing your bank. You’re always on. Sure, it’s fun — but it’s also about building trust and deepening relationships.

-Andrew Rietz

That dual purpose, he says, is one reason golf translates so well to the business of banking. “On a golf course, just like in a bank, you have a common goal. If I hit a bad shot, I need you to pick me up and hit a good one. It’s the same when you’re working toward a shared business objective.”

Rietz’s insights echo a broader truth shared by bankers across the region. Miguel Alban, National Director of Multicultural Banking and Greater Philadelphia Market Leader at Customer’s Bank, views the blend of commerce and sport in the following terms: “Golf is more than a game; it’s a setting where business and relationships naturally grow. The pace of play allows for meaningful conversations, the shared challenges on the course build trust, and the camaraderie creates connections that extend well beyond the 18th hole.”

Golf’s Slow Transformation: Adapting to a New Generation

Golf is not just for the retired bank CEOs. Despite the old-school image, golf is undergoing a quiet transformation. Public courses have expanded access, simulators and Topgolf locations have made the game more approachable, and digital tools have demystified swing mechanics. The COVID-era surge in outdoor recreation also introduced new players to the sport, including younger and more diverse professionals.

And with the rise of employee resource groups and inclusion initiatives in banking, some institutions are rethinking what professional bonding looks like. Pickleball leagues, wellness retreats, and structured community service events are gaining traction.

But Rietz sees golf’s unique combination of competition, camaraderie, and quiet connection as irreplaceable. “You can learn more about someone in a few holes of golf than you could in months of office meetings,” he says.

Final Thoughts: Still Par for the Course?

So, is golf truly the sport of bankers? Yes and no.

It’s no longer the universal currency of connection it once was. But in segments of the industry where trust, time, and personal interaction are still king — community banking, commercial relationships, private client work — it endures as a valuable asset.

A businessman commentator to the Greater Susquehanna Valley Chamber of Commerce blog was once asked about the number of million-dollar deals forged over an afternoon on the links. He wryly responded: “Depending on who you ask, the answers range from ‘lots’ to ‘all of them.’”

For bankers like Andrew Rietz — and echoed by bank leaders providing mentorship like Miguel Alban — that sounds about right.