Despite the rise in digital payments, cash transactions retain at least some of their relevance to modern consumers. Underscoring the historical significance of those nickels, dimes, and bills, here is a list of little-known facts about currency and credit.

Delve deeper into the fascinating world of currency and credit! This article explores surprising facts about the coins and bills you use every day, along with the history of how we pay for things:

Beyond the Face Value of Coins

In researching loose change, Harler highlights the following details:

- A once-common saying, “See a penny, pick it up; it will bring the day’s good luck,” is based on the ancient superstition that metals had the power to offer protection against evil

- The world’s most valuable coin is the 1933 Double Eagle, a $20 U.S. gold piece. Only 13 are known to exist, and one sold for over $7 million at auction

- The average lifespan of a typical coin is around 30 years; after that, its overall condition leads to its removal from circulation

- From a production cost standpoint, pennies have no value; minting a U.S. penny now requires an outlay of more than one cent, thanks in part to increases in metal costs

The Surprising Evolution of Dollar Bills

In addition to coins, foldable money, also has it’s own lore:

- The tradition of calling a one-dollar bill a buck stems from the era in which deer skins (buckskins) served as legal tender

- The average lifespan of a U.S. dollar bill is approximately 6.6 years

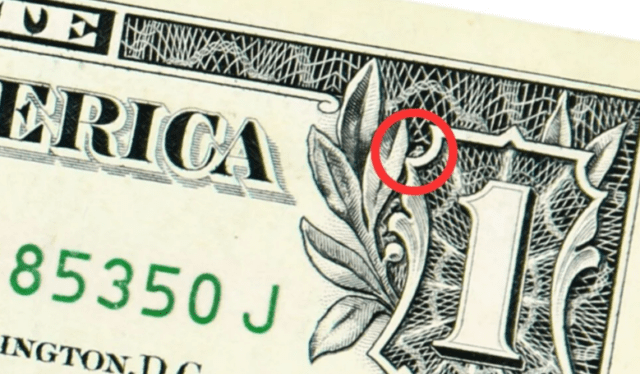

- Numerous symbols are printed on a U.S. dollar bill, and some are more obvious than others. In the upper right corner of a one-dollar bill, for example, rests a tiny owl on the frame around the number 1. It is there as a symbol of wisdom

- The largest global denomination banknote ever printed was the 100 trillion-dollar note from Zimbabwe. It was circulated in 2008 during a period of hyperinflation

The History of Charge Accounts

As sea change in global consumerism resulted from the introduction of credit cards. The history of payment systems was captured in a Holly Johnson article for Time, published January 8, 2024.

Credit “card” functionality dates to ancient Mesopotamia, where a purchaser presented a clay tablet on which financial transactions were recorded. The concept, however, took a significant leap forward in the U.S. in the late 1800s. It was then that the functionality of today’s credit cards started to emerge in the vintage “loyalty cards” that merchants provided as customer lines of credit.

The Rise of Credit Cards

From there:

- In 1949, telegram giant Western Union expanded its communications services by introducing “Metal Money,” which allowed customers to defer payments on money owed

- In the 1930s, the Chargea-Plate Group, Inc., became a purchasing option for payment for New York consumers. It was a rectangular sheet of metal holding user information that, when accompanied by customer signatures, enabled transactions

- The Diner’s Club Card debuted in 1950 as a piece of cardboard accepted only by 14 New York City restaurants. Its original 200 cardholders grew to 20,000 that initial year and to 42,000 by the end of 1951

- An American Express card came out in 1958 and, a year later, the company issued a plastic version that eventually became the industry standard

- In 1994, the technology of credit cards advanced yet again with the introduction of embedded chips to bolster the security of customer data and transaction storage

This brief look into the legal tender that average citizens have in their pockets and wallets contains a somewhat startling revelation. The common payment methods that are used every day to transact purchases actually overflow with depth and history that is unknown to many consumers.