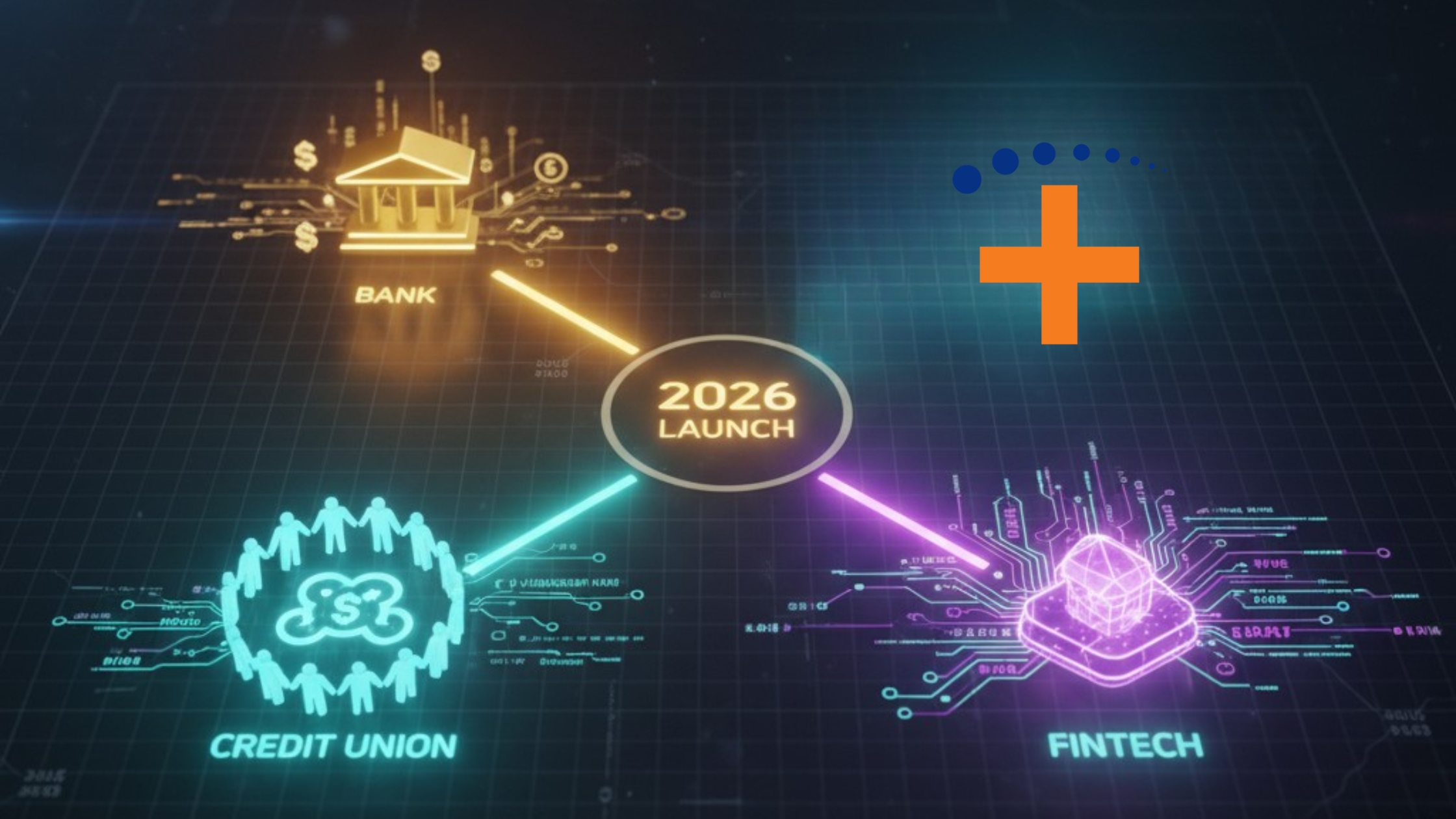

2026 Regulatory Landscape for Financial Institution Launches

As the financial services industry evolves into 2026, launching a new traditional community bank, federal credit union, or fintech company entails navigating markedly different startup landscapes in capital, legal, and regulatory requirements. For rising senior bankers and financial professionals preparing to make their mark, understanding these critical distinctions is key.

Capital Requirements for Startup Banks vs. Credit Unions vs. Fintech

For new community banks, the capital bar remains high. Starting capital is generally $9–$25 million, aligning with a regulatory mandate to maintain at least a nine percent Tier-1 leverage ratio under the Community Bank Leverage Ratio (CBLR) framework. This capital foundation is indispensable for managing risk and ensuring operational stability. As reported widely in industry guides and bank regulatory updates, this requirement reflects the rigor needed for banks serving the general public to thrive under close supervision.

In contrast, federal credit unions start with much lower capital thresholds—often between $2 million and $5 million—primarily raised from founding members. The National Credit Union Administration (NCUA) requires proof of financial viability and sufficient funds to cover initial operations until positive cash flow is achieved. This cooperative, member-centric model focuses more on building engaged membership than on maximizing capital buffers.

Fintech startups differ sharply in their capital expectations, facing no universal federal minimum. Instead, capital and bonding requirements depend on the states in which the fintechs operate and their specific activities, ranging from payment processing to lending. As explained in fintech regulatory overviews from sources including the U.S. Chamber of Commerce, this fragmented landscape demands adaptability and resourcefulness from founders.

Charter and Licensing: Diverging Regulatory Paths

Community banks seek charters through state authorities or the Office of the Comptroller of the Currency (OCC) for national charters. The process involves submitting detailed business plans, management expertise documentation, capital and liquidity plans, and community impact assessments, as reported by St. Louis law firm Lewis Rice. Separately, banks must secure Federal Deposit Insurance Corporation (FDIC) insurance, compounding regulatory complexity. This thorough vetting reflects the broad authority banks hold and the systemic risks they carry.

Federal credit unions file charter applications with the NCUA, outlining their proposed field of membership — whether community-based, associational, or occupational. The phased chartering system evaluates financial feasibility and member engagement early, reflecting credit unions’ cooperative ethos. Building and sustaining strong member relationships is as crucial as securing adequate funding.

Fintech firms operate under a patchwork of state licenses — money transmitter, lender, or others — depending on their business model, alongside federal compliance obligations such as the Bank Secrecy Act. The absence of a one-size-fits-all federal fintech charter, as noted by the U.S. Chamber of Commerce, underscores the need for strategic navigation of multi-jurisdictional regulatory regimes.

Industry Insights on Launch Success and Resilience

To complement the discussion of regulatory and capital frameworks, real-world perspectives—from Travillian Group podcasts and leading industry research—illustrate how financial leaders confront startup challenges and leverage strategic advantages:

- Steve Lundgren, CEO of Denali State Bank, highlighted on a Travillian Next podcast the importance of alliances like BancAlliance for new community banks facing market saturation and growth limits. These partnerships help banks overcome organic growth barriers, optimize capital, and navigate regulatory demands—underscoring the strategic ingenuity necessary for thriving startups.

- As reported by McKinsey, fintech startups succeed by pairing technological agility with disciplined execution. Modern fintech growth hinges on rapid product iteration, tight integrations with incumbent systems, and the ability to adapt to fragmented, state-by-state licensing and compliance requirements. This combination of speed and operational rigor enables fintechs to scale while navigating regulatory complexity.

- The Filene Research Institute (and other credit-union researchers) have recently underscored that resilience in strategy is nonnegotiable. Leading credit unions emphasize scenario planning, organizational alignment, and member-centric differentiation to withstand regulatory shifts and economic uncertainty.

Operational and Legal Distinctions Shape Institutional Identity

Distinct legal limits complement these differences: community banks serve broad markets with full-service banking under stronger governance and capital oversight; credit unions operate as nonprofit cooperatives with membership restrictions, emphasizing member welfare; and fintechs typically specialize in niche services without broad deposit authority, innovating within tailored regulatory confines. Understanding these operational and legal distinctions sets the stage for examining how leaders translate strategy into action in the real world.

Strategic Choices for Financial Startup Success

Launching a new financial institution in 2026 requires more than meeting capital thresholds and regulatory checklists — it demands strategic partnership building, resilience, and a deep commitment to technology as a core pillar.

Community banks must navigate capital-intensive, tightly regulated paths; credit unions will continue to grow through member-driven engagement; and fintechs will advance by turning regulatory complexity into innovation. Success will hinge on how effectively each one adapts, collaborates, and differentiates in a rapidly converging financial landscape.