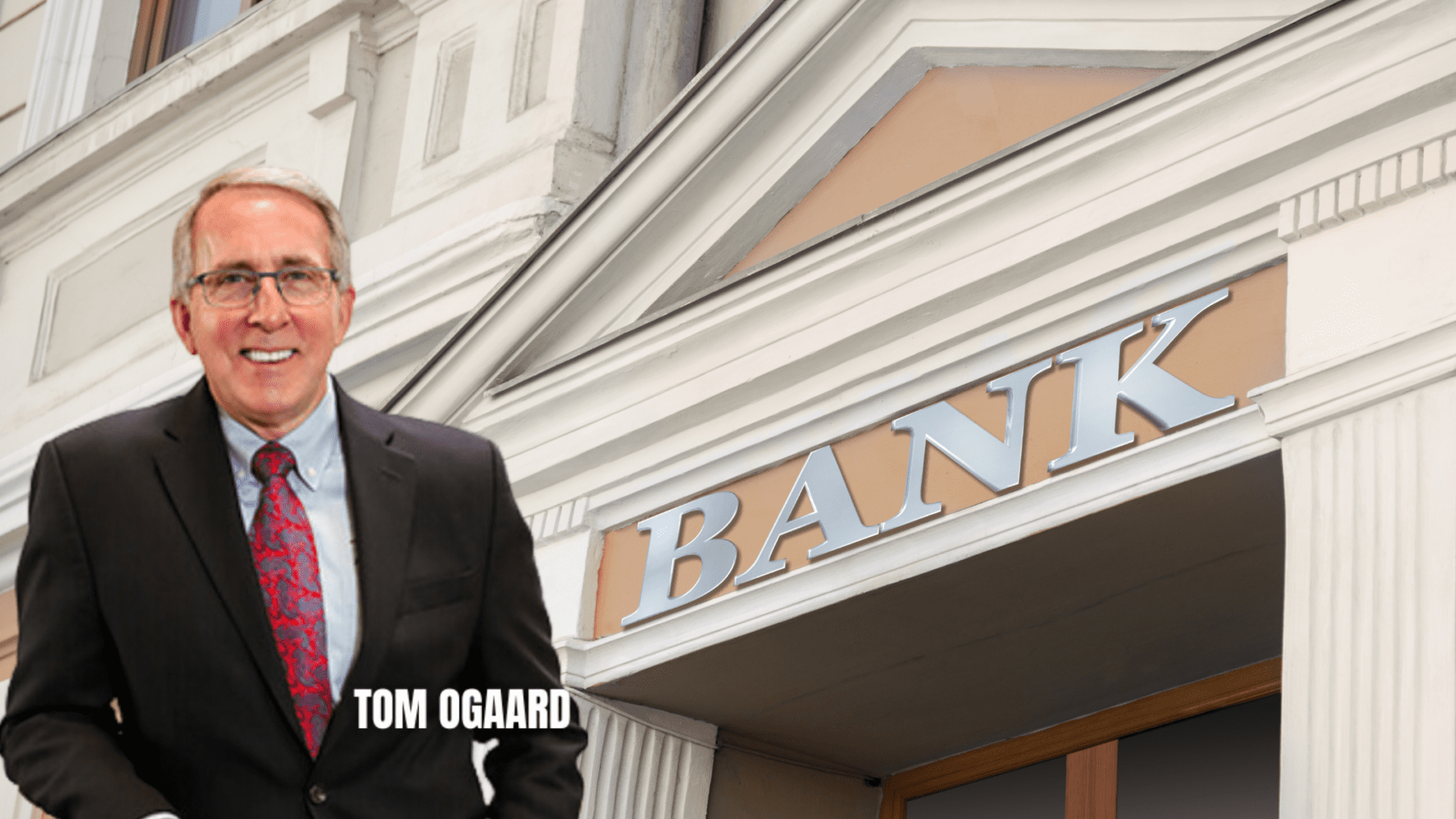

Tom Ogaard, President and CEO of Native American Bank, brings over 40 years of experience in the financial industry, with 12 years at the helm of Native American Bank. He sat down with Travilian’s Head of Banking and Fintech, Brian Love.

Ogaard’s introduction to tribal banking came in the 1980s, managing a bank branch on a reservation in Minnesota. That pivotal experience schooled him on the unique challenges of providing financial services to Native communities, sparking a lifelong commitment to the economic empowerment of this demographic.

Native American Bank Provides Financial Access to Tribal Communities

Native American Bank, based in Denver, was chartered through an act of Congress in 1998 and officially opened its doors in 2001. “As a mission-based financial institution, our role is to provide access to capital where it wasn’t previously available,” explains Ogaard. With loans currently spanning 30 states, the bank partners with Native-owned banks and Community Development Financial Institutions (CDFIs) to address gaps in financial access for reservation-based communities.

Challenges Facing Native American Communities

“About half of the Native American population in the U.S. still lives on reservations, many in remote areas,” Ogaard shares. These communities often face economic hardship, limited infrastructure, and minimal access to banking services. “Some reservations remain cash-based cultures, so part of our work involves financial literacy and demystifying banking to make it approachable.”

Investing in Native American Communities

Native American Bank has made a tangible impact through projects that foster economic development. “We’ve worked on everything from healthcare facilities and grocery stores to housing and renewable energy projects,” Ogaard notes.

One recent endeavor involved funding a 27,000-square-foot facility, including a laundromat, Subway restaurant, gas station, and grocery store. “This project created over 20 jobs and eliminated a 76-mile round trip for fresh food.”

Another example is a $10 million loan for an opioid treatment center, addressing a critical health crisis on a Midwest reservation. “Healthcare and housing are pressing needs for many tribes,” Ogaard explains. “Our projects create jobs, improve infrastructure, and offer hope for a more sustainable future.”

Leveraging Tax Credit Solutions for Tribal Communities

As a certified CDFI, Native American Bank has also tapped into the U.S. Treasury’s New Markets Tax Credit program, securing $50 million in allocations. “We’ve used these funds to support various initiatives, from expanding healthcare facilities to creating energy projects,” Ogaard shares. Partnering with other banks and non-bank CDFIs, the institution builds financial solutions tailored to tribal communities.

A Commitment to Native American Community-Based Banking

To better serve its growing portfolio, Native American Bank is expanding its presence. “We recently opened an office in Issaquah, Washington, and have plans for additional regional locations,” says Ogaard. This approach ensures the bank has teams embedded in the communities it serves, strengthening relationships and increasing efficiency.

A Vision for the Future of Native American Banking

Despite the challenges, Ogaard remains optimistic. “The sophistication among tribal leaders is at its highest level ever,” he says. “The work we do isn’t just about financial transactions—it’s about creating opportunities and fostering hope. The projects we support today will lay the foundation for a stronger future.”

Native American Bank’s commitment to empowering tribal communities continues to grow, one project and one partnership at a time. “We’re here to build relationships, provide resources, and bring transformative change to Native American communities nationwide,” Ogaard concludes.

The full interview with President and CEO of Native American Bank, Tom Ogaard, can be found on TravillianNext.